Why is data provenance critical for KYC and the shift to AI and pKYC?

Data provenance ensures clean, accurate, and complete client information is collected, integrated, and governed consistently across systems.

With strong data foundations, banks can move beyond static, document-driven KYC processes toward perpetual KYC (pKYC), continuously refreshing client profiles, capturing real-time risk signals, and safely applying AI to drive dynamic compliance across the client lifecycle.

What is data provenance in KYC?

Data provenance is an organization’s ability to collect clean, accurate, and complete data from all relevant sources. It includes integrating data consistently using standardized, rules-based processes and organizing it to eliminate silos, enabling a single client record reduce silos and duplication. Clear governance, with defined ownership, consistency, lineage, and compliance, is essential.

In KYC, data provenance means a single, trusted client view, reliable documentation, and minimal duplication. It forms the foundation for pKYC, shifting banks from reactive reviews to continuous, proactive monitoring. Decisions are driven by a dynamic, continuously refreshed source of truth across onboarding, monitoring, and the full lifecycle.

AI is essential for perfecting pKYC. With mature data, AI can automate correlation, detect emerging risk signals, and provide actionable insights in real time. Combining intelligent automation with human oversight allows banks to continuously update client profiles and streamline compliance.

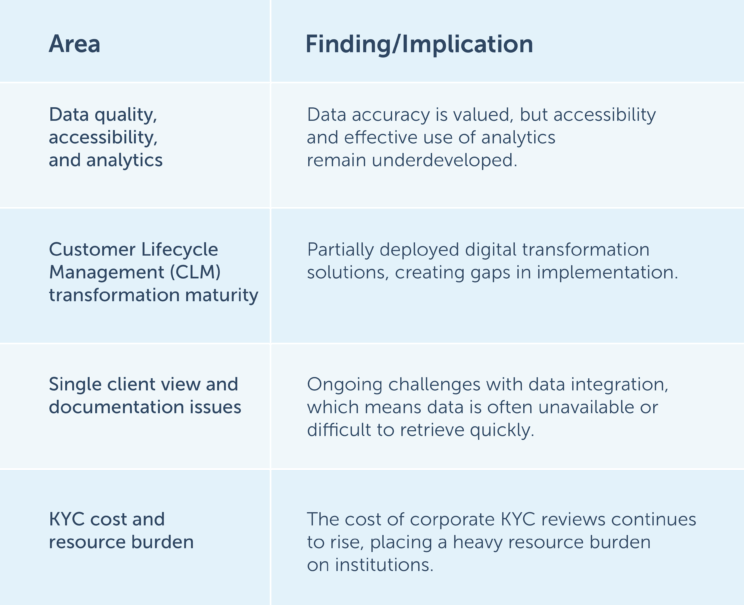

Evidence of data provenance gaps

Despite years of investment, many banks still struggle with fundamental KYC challenges. Gaps in data quality, limited digital transformation, fragmented client records, and rising compliance costs highlight the need for stronger foundations. Without mature data, banks cannot effectively implement perpetual KYC (pKYC) or leverage AI to automate and enhance compliance processes.

Many banks remain at early or intermediate stages of KYC data maturity or provenance, with the following implications:

These findings make it clear: sub-optimal data maturity hampers banks’ ability to implement pKYC and fully harness AI.

AI and the journey to pKYC opportunity

AI cannot deliver value without reliable, high-quality data. Regulators also expect explainability, which requires strong governance and oversight. Equally important, AI must be accurate, which depends on access to real-time data, seamless system integration, and continuous monitoring. Without these, models degrade, ROI falls, and risks increase.

Accuracy, enabled by real-time data, integrated systems, and ongoing oversight, is what allows banks to realize immediate benefits. For instance, faster onboarding, improved risk insight and reduced manual effort, even before pKYC. Instead, these gains lay the foundation for a future where pKYC becomes achievable.

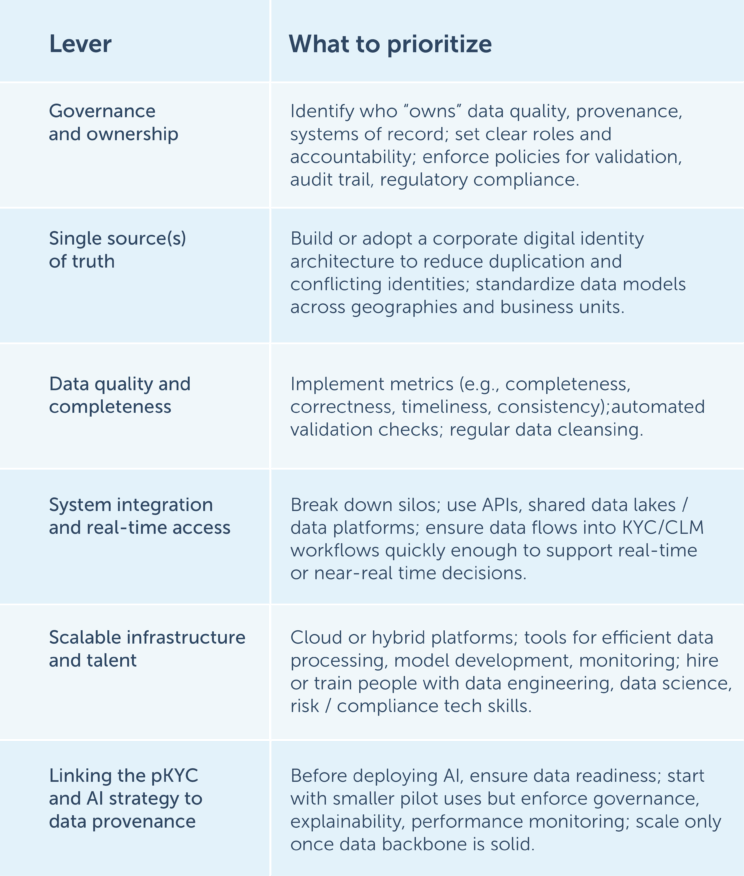

What senior executives should do: Maturity levers and roadmap

To move toward high data maturity, that supports strong KYC, pKYC transformation and AI capabilities, executives should focus on the following strategic levers:

Risks of not acting

For corporate banking executives, investing in data provenance is mission critical. It is the foundation for effective KYC today, the enabler of pKYC tomorrow, and the only way to unlock the safe and scalable use of AI.

By acting now, banks can move away from costly, static reviews and towards a model of continuous refresh, powered by real-time data and intelligent automation, which reduces risk, lowers cost, and enhances customer experience. The future of KYC is perpetual and AI-enabled, and only those with mature, trusted data foundations will be ready to deliver it.

Discover corporate digital identity from Encompass