Harness the power of CDI

Corporate Digital Identity (CDI) is a game-changing technology led approach to corporate identification, verification and validation. Encompass uniquely combines data attributes and original source documents from authoritative public data sources and a bank’s client. Make your KYC data a valuable business asset when collated into fully auditable digital client profile and reused as part of a perpetual KYC (pKYC) program and across the business.

Delivering sustainable business value through Corporate Digital Identity (CDI) requires a blend of cutting-edge technology, powered by real-time data and access to expertise to employ best practice and optimize end-to-end KYC processes.

Deliver 32% end-to end onboarding process time saving in year one*

*Based on 100 profiles at a Tier 1 bank and research conducted with Chartis Research. This will change based on risk appetite, jurisdiction and complexity of the customer book.

Keeping good company: streamlining client onboarding with CDI

In our three-part report series developed in partnership with Chartis we examine the corporate client onboarding challenges banks face and how to address them.

CDI ROI calculator

From improved client experience, operational efficiency gains to robust risk mitigation and regulatory compliance, find out what CDI could mean to your organization.

Helping clients maximize value

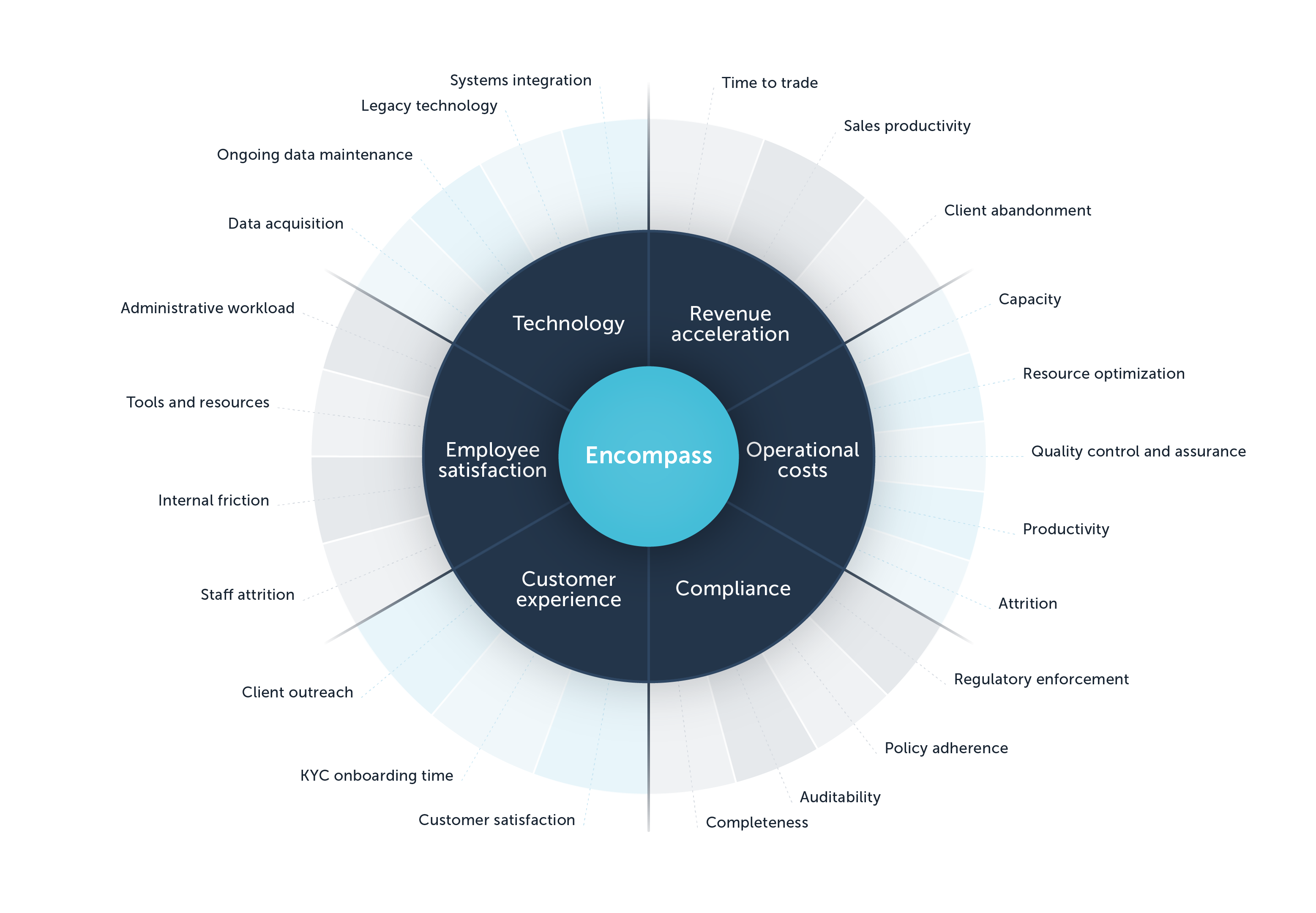

Our experts work in partnership with you to lead, guide and instill best practice into the transformation and digitization of your KYC process through the implementation of the Encompass CDI platform.

Central to our approach is ensuring you deliver on what matters most to your business at any point.

Which areas are most important to your bank?

Get in touch to discuss what the EC360 platform and our innovative EC solutions can do for your organization.

Our solutions

EC360 CDI platform

Fast, accurate customer identification, verification and verification. EC360 automates the manual KYC search process and combines live public data and documents from authoritative global sources with private customer information, to create and maintain digital risk profiles.