The leading Corporate Digital Identity platform

Need further assistance? Visit Support Centre

EC360 is an award-winning corporate digital identity (CDI) platform designed to empower banks with unparalleled insights and efficiency. By seamlessly validating and verifying corporate clients, EC360 delivers a real-time, holistic, 360-vision of corporate identities.

Our cutting-edge platform integrates global public data with private client information, seamlessly automating the collation of real-time documents and data while securely exchanging sensitive information. The result? Comprehensive, ready-to-use digital risk profiles that eliminate manual processes and enhance decision-making.

EC360 seamlessly collects, organizes, and consolidates data from a bank’s approved public sources and with private sources client information to meet specific regulatory and business requirements. Automation rules streamline straight-through processing (STP) and ensure that only the most relevant information is consolidated into a unified, actionable output.

Designed for flexibility, EC360 is data-agnostic and allows banks to tailor the information they want to collect on their clients.

Live connections to corporate and UBO registries, regulators and, stock exchanges, and data vendors provide real-time access to essential attributes and documents, including data from screening, identity verification (IDV), and business information vendors.

Secure outreach requests are automatically sent to clients to confirm the accuracy of existing information or provide additional details. Clients can store and share sensitive documents in a secure, private digital vault for streamlined communication.

Advanced technologies enable seamless integration and intelligent use of the collected data.

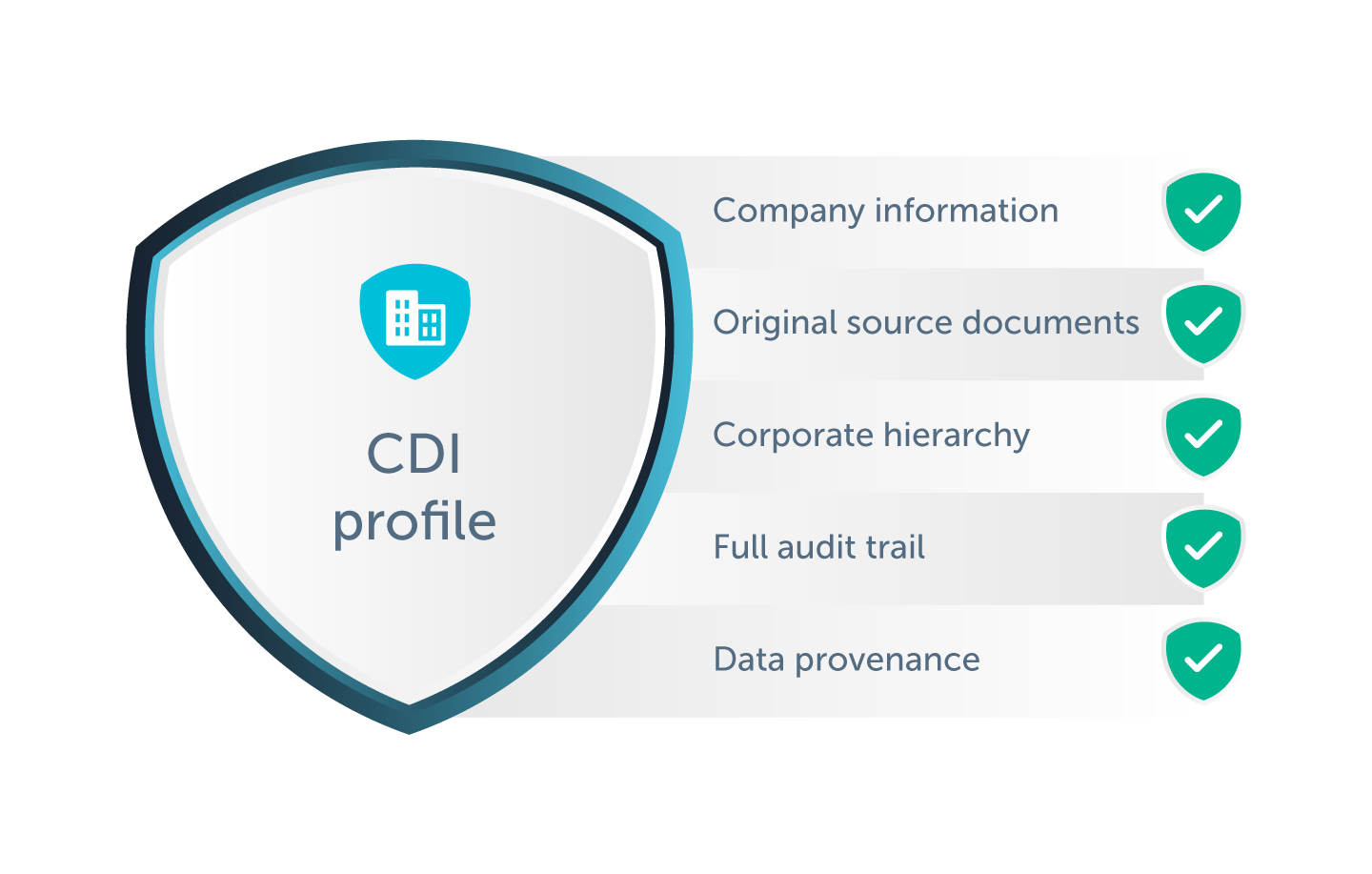

The dynamic CDI profile combines verified public and private information into a comprehensive digital record that includes:

This digital record can be maintained and continuously monitored as part of a perpetual KYC (pKYC) program, empowering banks to proactively manage risk. Attributes within the CDI are fully customizable and tailored to meet specific regulatory and operational needs.

EC360 is delivered as Software as a service (SaaS) and designed for seamless integration and accessible via an intuitive user interface (UI) or robust API. Digital profiles are available in multiple formats and enable effortless incorporation into existing banking systems including existing or third-party client lifecycle management (CLM) and workflow solutions. With the support of our global transformation team of KYC and banking industry experts, prebuilt integrations and strategic partnerships banks can achieve rapid deployment and long-term ROI realization.

Our solutions are designed to enhance your existing tech stack and can seamlessly integrate with digital transformation initiatives. Whether addressing new product launches, client onboarding, subsidiary expansions, jurisdictional compliance, periodic reviews, or remediation triggered by pKYC events, these comprehensive solutions include:

Effortless collation of public KYC data and documents for fast and frictionless compliance.

Deliver 32% end-to end onboarding process time saving in year one*

*Based on 100 profiles at a Tier 1 bank and research conducted with Chartis Research. This will change based on risk appetite, jurisdiction and complexity of the customer book.

EC360 offers transformative benefits that go above and beyond.

This combination of advanced features and proven expertise makes EC360 the strategic choice for banks seeking scalable, secure, and client-centric transformation.

Find out what CDI could deliver for your organization.

Regulatory compliance and risk mitigation: Ensure robust adherence to global standards.

Enhanced trust and reputation: Build confidence with clients and stakeholders.

Operational efficiency: Achieve significant cost and time savings with automation.

Superior client experience: Simplify and elevate every client interaction.

Growth opportunities: Enable new business prospects with confidence and agility.

Security is at the core of EC360 and our EC solutions. Hosted across multiple cloud environments, EC360 adheres to the highest industry standards, including ISO 27001 certification, AICPA SOC 2 compliance, and EU GDPR/UK DPA alignment. All data is encrypted both at rest and in transit, with regular backup and recovery testing ensuring resilience and reliability.

Watch this video to understand the key stages required to develop a CDI.