$8.14 billion of AML fines handed out in 2019, with USA and UK leading the charge

To view more recent industry insights from 2024 please visit our blog highlighting research conducted by Chartis and Encompass. The report series investigates challenges banks encounter in corporate client onboarding.

An analysis of Anti-Money Laundering (AML) fines handed down in 2019 carried out by Encompass Corporation has provided insight into the key trends.

Key observations from our AML fines analysis:

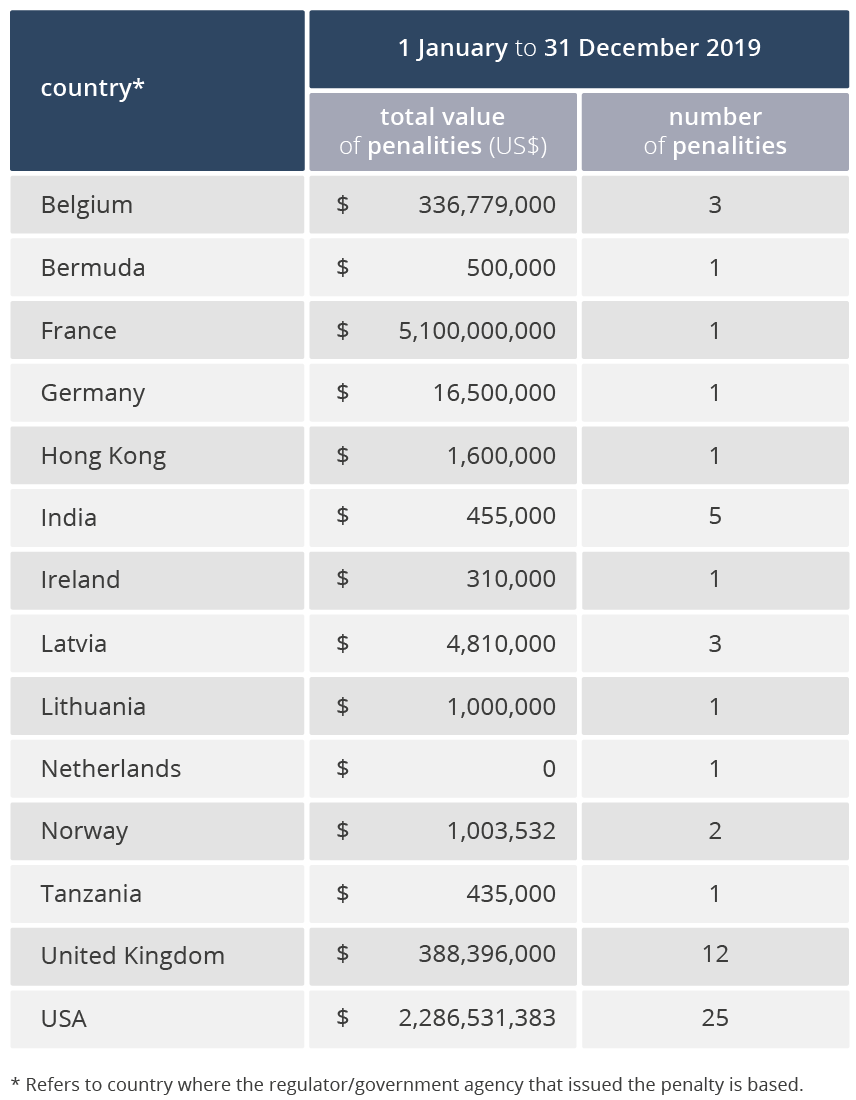

- 58 AML penalties handed down globally in 2019, totalling US$8.14bn

- This is double the amount, and nearly double the value, of penalties handed out in 2018, when 29 fines of $4.27bn were imposed

- Regulators in the USA were most active, handing out 25 AML penalties totalling $2.29bn

- UK followed with 12 fines totalling $388.4m

- Largest monetary fine was $5.1bn and originated from France

- Average monetary fine for 2019 was $145.33m

- 2019 was record year, in terms of number of AML penalties handed out (58), ahead of 2016 (47)

- Under half of penalties given out in 2019 were to banks (28 of 58), compared to two-thirds in 2018 (20 of 29)

- Penalties handed down by regulators across multiple jurisdictions beyond the USA and UK: these were Belgium, Bermuda, France, Germany, Hong Kong, India, Ireland, Latvia, Lithuania, the Netherlands, Norway and Tanzania

2014 still holds the record for the highest total value of AML fines at $10.89bn, but this includes an anomalously large penalty of $8.9bn. If this were to be removed, 2019 would take the lead.

The Encompass view

Wayne Johnson, CEO and co-founder of Encompass, said:

Since 2015, annual AML penalty figures have been steadily rising each year. Multi-million dollar fines have been commonplace for a while, but we are now seeing more penalties of one billion dollars or over, with two in 2019 alone.

Historically, the majority of these fines have been given to banks, but this year the proportion was less than half, demonstrating that money laundering is now recognised as a general business issue, not just one that is specific to financial services.

Regulators in the gambling/gaming sector were particularly active in 2019, handing out five fines, all of which were well over $1 million and the highest being $7.2 million. Interestingly, four of these were in the UK, demonstrating a crackdown here.

The USA continues to lead the way, having handed out the most penalties this year at 25 – more than twice the amount of the UK, the country in second place.

Given that these two countries have transparent regulatory cultures and active regulatory bodies, we expect we shall continue to see the largest number of fines originate from here, but we are seeing activity from increasing numbers of jurisdictions as time goes on. For example, in 2019, penalties were handed out by 14 countries, compared to just three a decade ago in 2009.

We are not expecting the spotlight on money laundering to dim. The continued and increased focus on this area highlights the severity with which it is viewed at a global level, which is not surprising given the negative economic and societal repercussions it can have. As we head into 2020, we shall continue to monitor and analyze AML penalty data with interest to see how it evolves.

Methodology

The underlying data for this analysis was supplied by Dr Henry Balani, Head of Delivery Services at Encompass, and a recognised compliance and AML specialist and academic.

All data was compiled from reputable national news sources and cross referenced against regulator websites where available. Penalties and actions from active jurisdictions where cross-border financial transactions are high were included in the research.

While, occasionally, there are smaller, less active jurisdictions or agencies that impose penalties, these amounts are typically smaller and do not necessarily affect overall trends and were not included in this research.

Discover corporate digital identity from Encompass