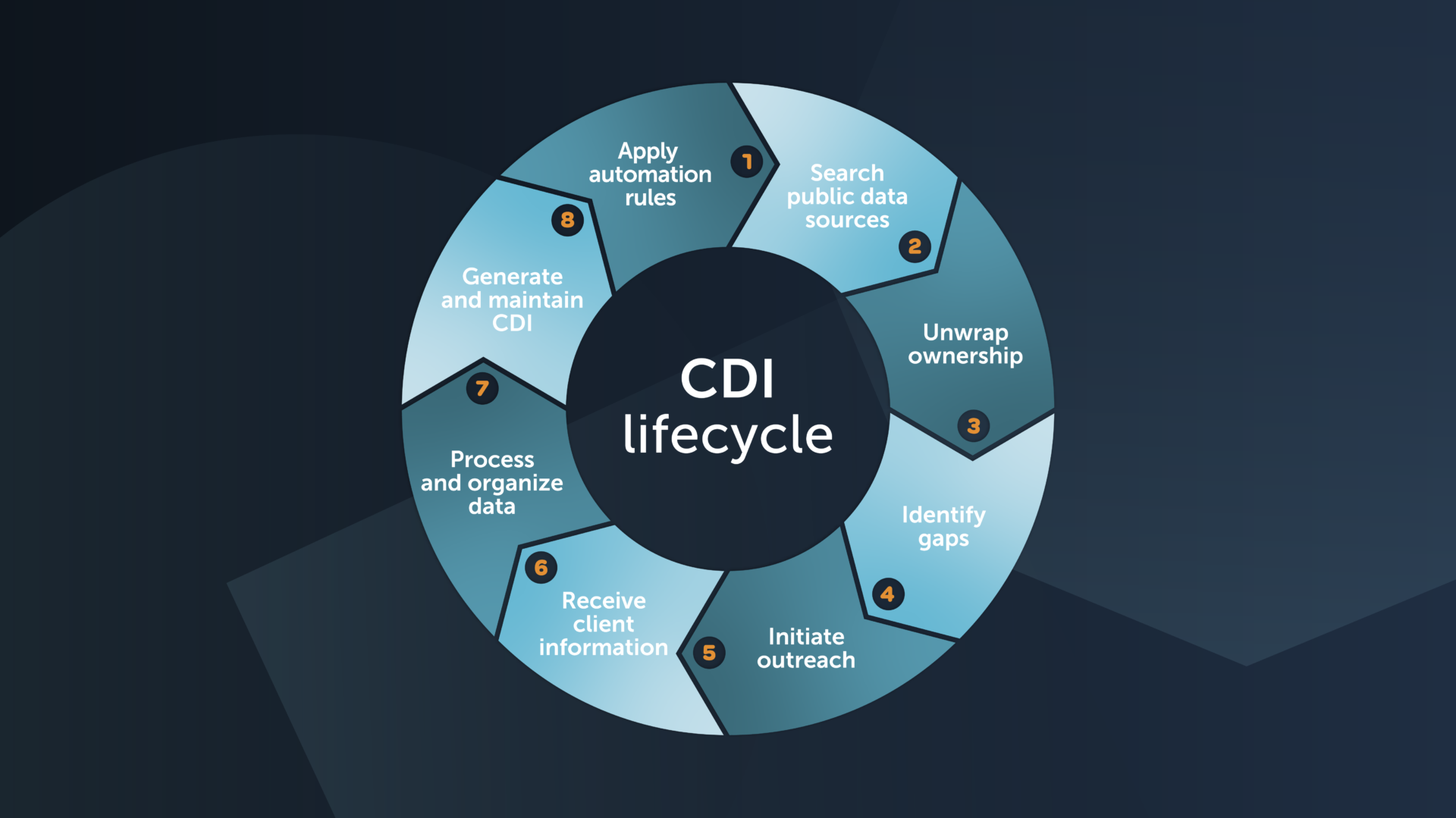

Building an effective strategy for the Corporate Digital Identity lifecycle

A well-structured Corporate Digital Identity (CDI) operating model is crucial for banks wanting to stay ahead and streamline corporate client identification and verification.

This blog outlines the pathway to creating an effective approach to CDI. Highlighting how automation and advanced data processing techniques are critical to the process.

The CDI generation process is triggered by events such as new bank products, client requests, subsidiary or jurisdictional changes, periodic reviews, remediations, or perpetual Know Your Customer (pKYC) triggers.

1: Apply client requirements

The first step, initiated through a client lifecycle management (CLM) or customer relationship management (CRM) system, involves applying client-specific requirements. These are to cover the entity being onboarded or maintained. Additionally, to understand the purpose and nature of the relationship and products involved.

However, ensuring their consistent application can be challenging when performed manually. The EC360 platform from Encompass can be configured to collect, combine, and organize data based on a bank’s unique needs. Automation rules optimize straight-through processing (STP), ensuring relevant data is efficiently organized into a consolidated output consistently.

2: Search public data sources

Next, publicly available data attributes and documents are sourced directly via live connections. These can be from corporate and ultimate beneficial owner (UBO) registries, regulators, and stock exchanges. Additionally, data vendors provide screening, identity verification (IDV), and business information. This step ensures that all necessary public data is gathered efficiently and accurately without the complexity of managing multiple sources.

3: Unwrap ownership

This is where the true power of automation kicks in. The collected data, including unstructured and structured information extracted from documents via intelligent document processing (IDP) using Generative artificial Intelligence (GenAI), is combined using advanced entity resolution techniques.

Customized hierarchy rules are applied to standardized and normalized data. As a result, resolving any conflicts and revealing the beneficial ownership structure of an entity. Additionally, automated screening can be conducted on associated individuals, providing a comprehensive view of the ownership landscape.

4: Identify gaps

In this crucial step, any information that is not available in the public domain is identified for collection through direct client outreach. This can also include essential data points and documents that require confirmation or attestation directly from the client.

By proactively pinpointing these information gaps early in the process, banks can streamline their data collection efforts.

5: Initiate outreach

Secure and streamlined outreach requests are automatically generated for bank clients to provide the additional information. Alternatively, to confirm the accuracy of the publicly collected or existing information, utilizing pre-filled templates. Comprehensive and flexible dashboards offer transparency and control over the entire outreach process, ensuring efficient and effective data collection.

6: Receive client information

Outreach requests and attestations are managed by the client in a secure vault, where they can store, organize, and permission their private information. Clients can respond to requests quickly and easily, ensuring that their information is kept up-to-date and organized. This secure management of data facilitates smooth and efficient communication between the bank and its clients.

7: Process and organize data

New information collected from the client is combined with the public data and documents, leveraging the same techniques used in step three. IDP, entity resolution, normalization, standardization, and hierarchy rules are applied. Furthermore, screening is conducted when required, ensuring comprehensive and accurate data processing.

By combining these techniques, banks can seamlessly integrate newly collected client information with existing public data and documents. Consequently, this enhances the overall accuracy and completeness of the data, ensuring a more reliable foundation for decision-making. Moreover, this comprehensive approach guarantees that all relevant information is thoroughly processed and incorporated, ultimately providing a robust and up-to-date view of the entity.

8: Generate and maintain CDI

A CDI is created dynamically from the matched and merged public and private company information. It includes original source documents, corporate hierarchy, a full audit trail, and data provenance. A CDI profile is available in multiple digital formats to ensure seamless integration into banking systems. Additionally, providing a comprehensive record for audit and regulatory compliance.

This digital record can be maintained and monitored as part of a continuous or pKYC program to proactively manage risk. When there is a change in public or private data, it can be flagged for refresh. Enabling the trigger of a materiality assessment request.

The profile is held securely, ensuring that only authorized users with the necessary access and permission rights can view and interact with it. This valuable data can power Client Lifecycle Management (CLM) systems, driving more informed decisions throughout the entire customer journey. Moreover, the data is reusable across various departments and functions within the bank, from onboarding to compliance and risk management, helping to eliminate data silos.

By enabling seamless data sharing while maintaining strict access controls, banks can enhance collaboration and efficiency, ensuring the right teams have the insights they need.

Delivering a CDI lifecycle strategy

A well-structured CDI operating model is a game-changer for banks because it enables them to unlock growth potential while simultaneously navigating an ever-evolving regulatory landscape. Furthermore, by implementing these transformative steps, banks can develop a powerful CDI that not only manages risk and ensures compliance but also drives operational efficiency, enhances data accuracy, and powers digital transformation. As a result, this comprehensive approach strengthens their ability to stay competitive and future-ready in an increasingly digital world.

This transformation leads to a superior client experience, positions banks to scale more effectively, and empowers them to stay ahead of the curve in an increasingly digital-first world.

Discover corporate digital identity from Encompass