Why corporate digital identity will change your approach to KYC transformation

Adopting corporate digital identity (CDI) offers a transformative pathway to know your customer (KYC) transformation.

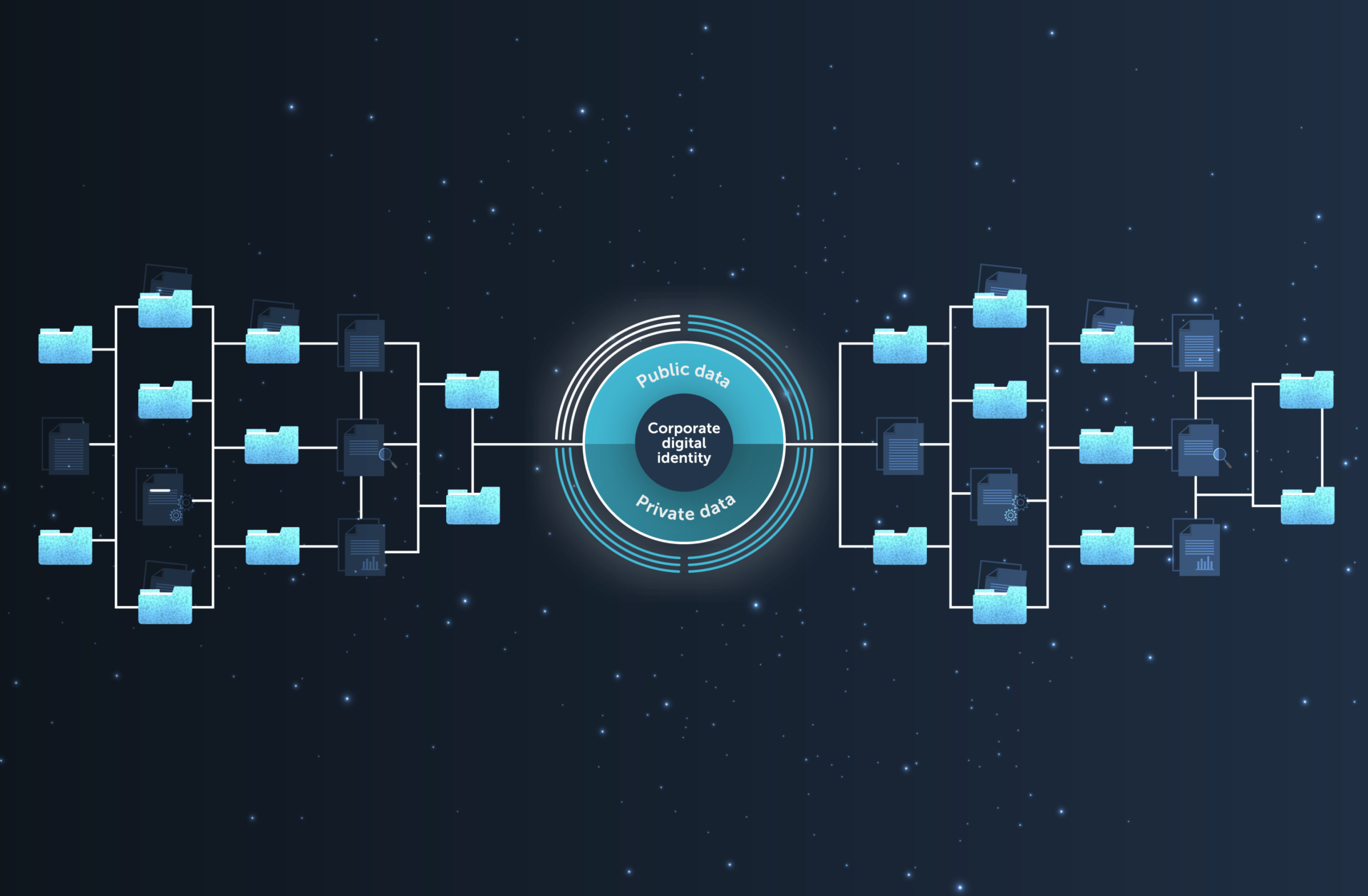

By integrating real-time data from public and private sources, CDI enhances compliance, accuracy, and efficiency in client onboarding. This approach not only streamlines processes but also improves the customer experience for both banks and their clients.

Six challenges of manual KYC processes

- High levels of manual review increase the risk of human error and delays.

- Repeated requests for already available information frustrate customers, contributing to $3.3 trillion in lost revenue from abandoned applications.

- Stale and inaccurate data hampers efficient account verification, increasing risk.

- Accessing global business data is challenging, leading to performance issues, and longer onboarding times for cross-border verification.

- Analyzing complex ownership structures and dealing with jurisdictional variances is time-consuming and often lacks the detail required for regulatory compliance.

- Different departments reaching out to the same clients for similar information causes frustration and missed opportunities due to siloed data.

Key purchasing criteria to transform KYC with CDI

As banks transform, the adoption of advanced technologies and automated solutions becomes essential. Banks have already identified four key drivers for transformation: –

- Accuracy: 96% prioritize accurate data.

- Compliance: 88% want solutions that ensure regulatory compliance.

- Data Freshness: 84% emphasize up-to-date data.

- Automation: 74% seek automated processes to reduce manual intervention.

How CDI addresses key drivers

Accuracy: The cornerstone of trust

Public data, sourced from government databases, financial records, and international registries, provides foundational KYC information. Private data, specific to the client and often held internally, offers additional detailed information.

Building a single CDI profile integrates both data types, addressing issues with outdated information and repeated data requests. Key processes like normalization, hierarchy rules, and entity resolution eliminate duplicate records and streamline data integration.

Normalization transforms both real-time public and private data into a consistent format, facilitating easier comparison and integration. While hierarchy rules establish the most authoritative data source when conflicts arise. Furthermore, entity resolution identifies and links records referring to the same entity across various sources.

Compliance: Navigating the regulatory landscape

As regulations become stricter, banks must ensure their KYC processes meet all legal requirements to avoid penalties and reputational damage. CDI solutions are designed to stay updated with the latest regulatory changes and real-time data. Combined with periodic refresh of the profile, CDI enables perpetual KYC (pKYC) of the most important data points. Therefore, reducing the burden on compliance teams, as all necessary checks are conducted consistently.

This comprehensive compliance strategy not only mitigates risk but also enhances the bank’s credibility and trustworthiness in the eyes of clients and regulators.

Data freshness: Keeping information current

The main benefit of transforming KYC with CDI is the automated creation of a profile using live public and private data. This automation, coupled with periodic refreshes, enables banks to stay updated through continuous synchronization with government databases and international registries.

The resulting comprehensive and real-time view allows for faster onboarding and a more streamlined experience for both banks and clients. Additionally, the integration of real-time data ensures that banks can swiftly respond to changes in client information, maintaining ongoing compliance and efficiency in KYC processes.

Automation: Streamlining processes

CDI automates data collection and the unwrapping of corporate structures to identify beneficial ownership, significantly reducing the time and effort required for manual checks. Integration with global data products ensures access to relevant and authoritative information, supporting banks’ specific needs and regulatory requirements.

By centralizing both internal and external information into a CDI, banks can leverage a single digital profile accessible across all departments. This integration eliminates data duplication and the risk of stale information across disparate systems, allowing for more efficient processing of updates and alerts. As a result, banks can avoid repeatedly asking clients for the same information, ensuring a seamless and efficient customer experience while solidifying trust and satisfaction.

The future of KYC transformation

Banks that transform KYC with CDI lay the foundation for perpetual KYC (pKYC), enabling continuous monitoring and updating of client information. This approach ensures that client data remains current and accurate, enhancing compliance and risk management.

To fully benefit from advanced KYC solutions, banks must prioritize digital transformation, allocate sufficient budgets, and connect fragmented data landscapes. Enhancing corporate transparency and ensuring compliance with evolving regulations are essential steps. As regulations become stricter and the need for robust verification grows, CDI will be vital for maintaining compliance.

Addressing the key purchasing drivers of accuracy, compliance, data freshness, and automation, banks can transform KYC with CDI, ensuring robust, efficient, and customer-centric operations. This holistic strategy transforms the traditional KYC framework into a more effective model that adapts to evolving regulatory demands and client expectations.

Discover corporate digital identity from Encompass